IIROC Enforcement Report highlights progress made in enhancing investor protection

TORONTO, May 11, 2020 /CNW/ - The Investment Industry Regulatory Organization of Canada (IIROC) today released its annual Enforcement Report, which includes highlights of key cases prosecuted and the progress in enhancing its legal authority from coast to coast.

In 2019, IIROC:

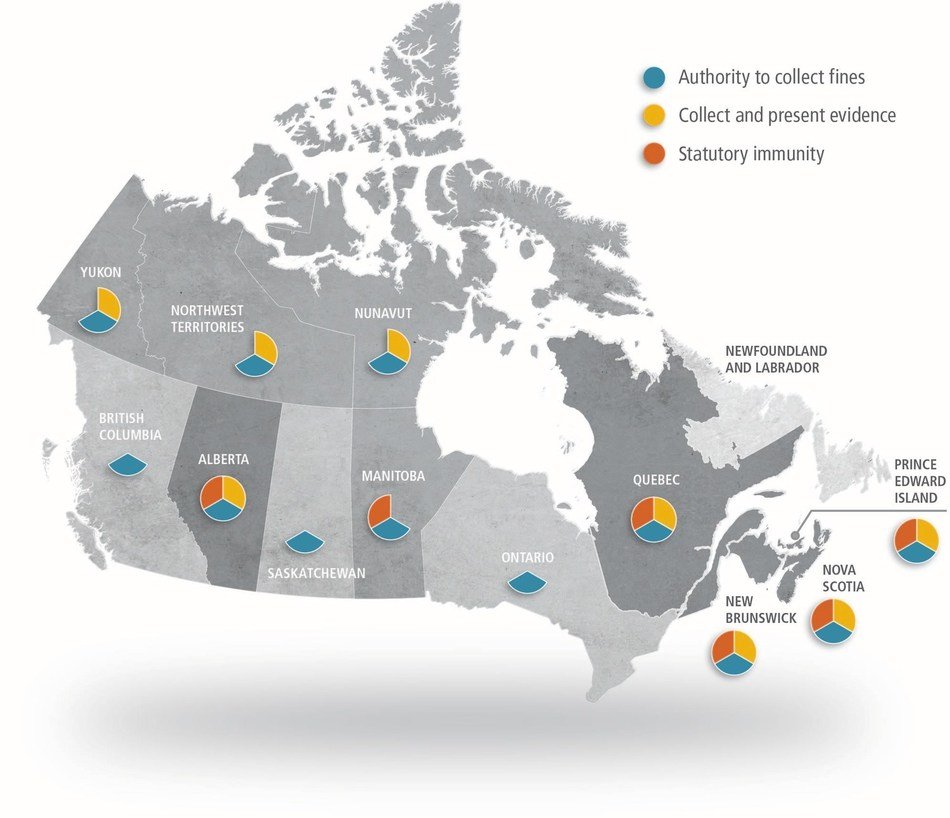

- secured stronger legislation in New Brunswick, which joined 8 other provinces and all 3 territories in giving IIROC improved ability to protect investors by holding wrongdoers accountable for their actions

- saw the number of disciplinary hearings initiated nearly double – from 8 in 2018 to 14 in 2019, resulting from an increase in contested matters, some of which are still ongoing

- completed 104 investigations, and prosecuted 28 individuals and 8 firms

- suspended 14 individuals and permanently barred 3 individuals

- imposed total sanctions of $1.8 million against IIROC-regulated firms, marking the highest amount since 2013

- imposed total sanctions of nearly $2 million against individuals

- collected 29 per cent of fines against individuals and 97 per cent of fines against firms

- investigated and prosecuted cases where suitability represented the largest volume, with seniors and vulnerable investors representing one-quarter of cases reviewed and nearly a third of all prosecutions

"IIROC has achieved success in securing enhanced authority in nearly all provinces and territories," says Elsa Renzella, IIROC's Senior Vice-President, Registration and Enforcement. "We plan to continue our pursuit for improved legal authority – and will also take steps toward advancing our new initiatives to give IIROC a tailored, proportionate disciplinary response and to better support investors who suffer losses."

IIROC continues to build upon its extensive public consultation on two new proposed disciplinary programs: a Minor Contravention Program (MCP) and Early Resolution Offers (ERO). Over the past two years, IIROC has received comment letters and held focus groups with various stakeholders, including investor advocates. Additionally, IIROC conducted a national survey of over 1,000 investors.

Based on feedback, IIROC revised its proposed programs and published a second Request for Comment in 2019. Three significant changes included making firms ineligible for the MCP, increasing fines for individuals, and reviewing all MCP cases by a one-person hearing panel. IIROC intends to publish its response to comments and proposed next steps later this year.

Comments

There are 0 comments on this post