Justt Comes Out of Stealth, Announces $70M in Funding to Take On Antiquated Chargeback System

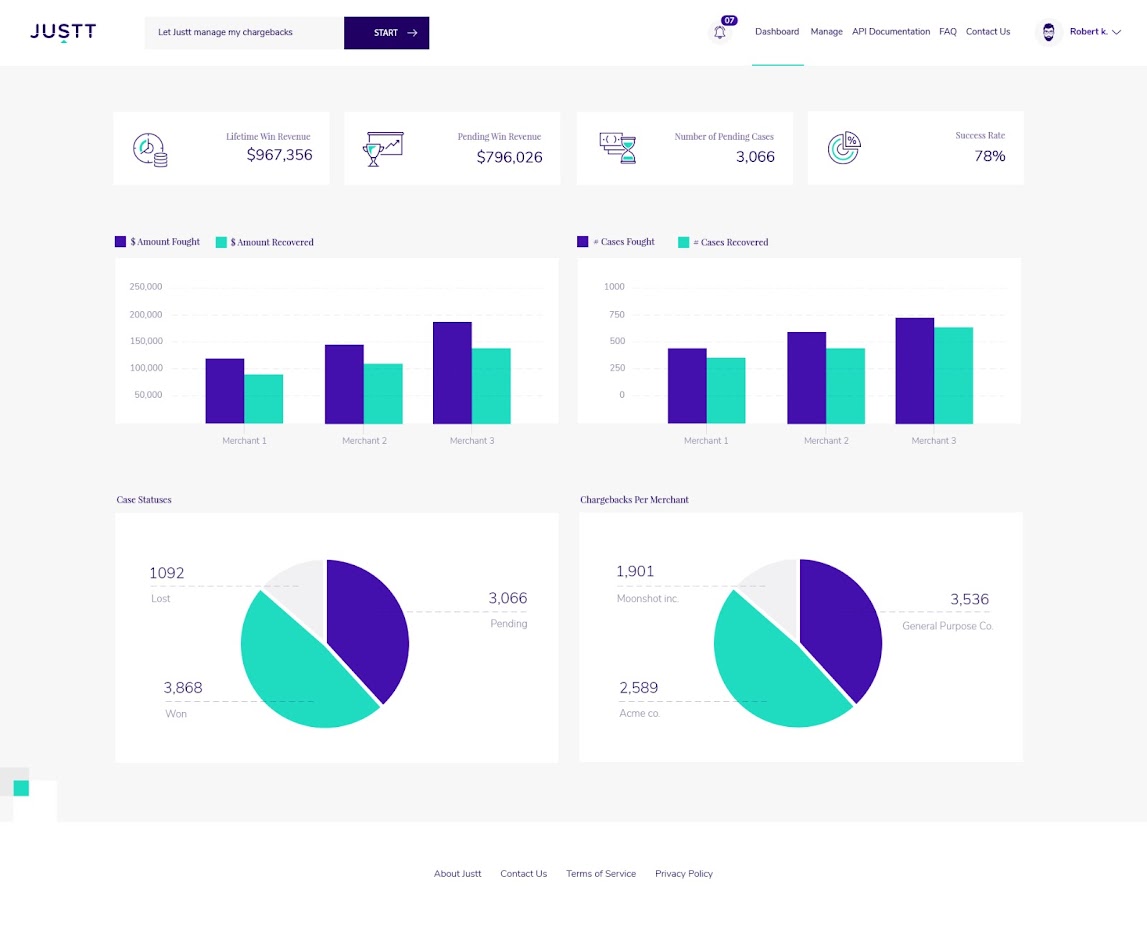

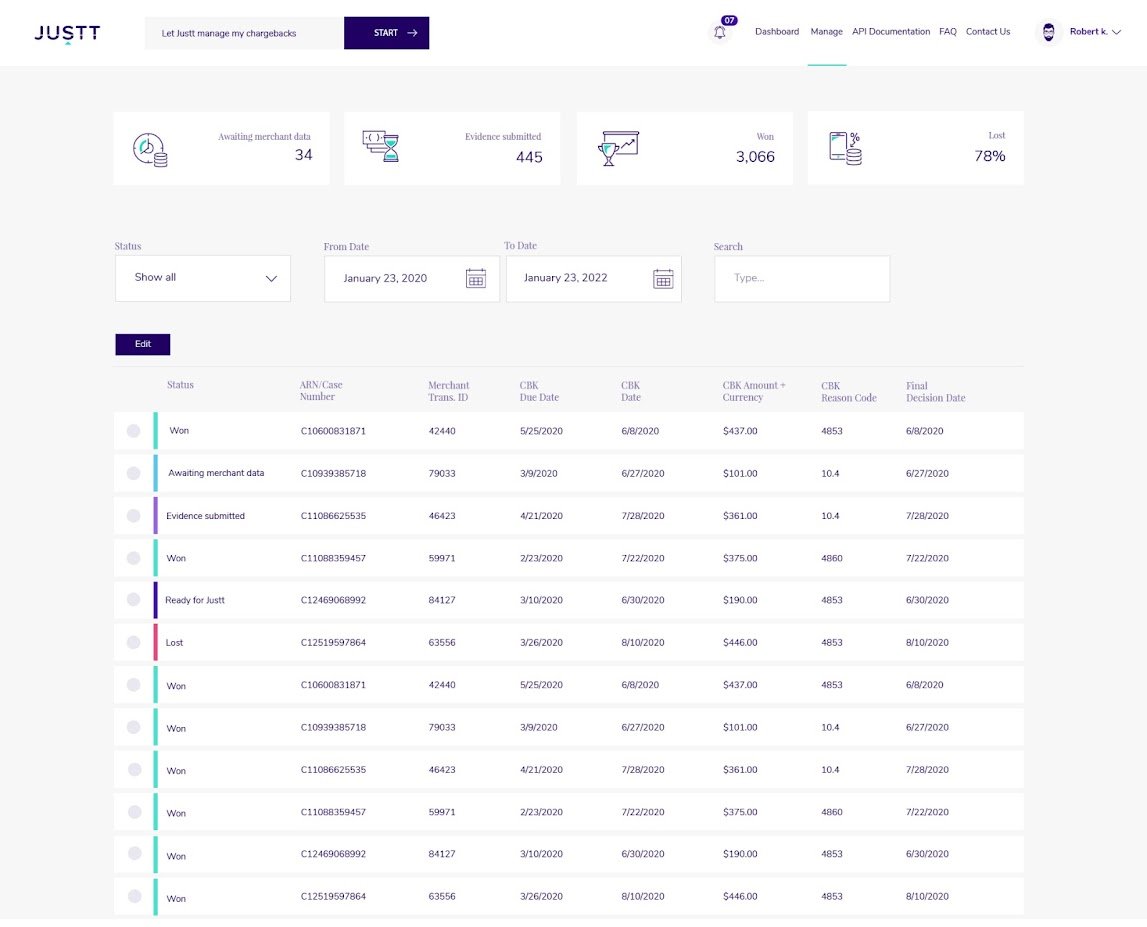

Machine learning solution helps online merchants prevent 85% of “friendly fraud†credit card disputes Toronto, November 16, 2021 -- Justt, a chargeback mitigation pioneer, today announced that it has raised $70 million in funding as it expands its mission to help global merchants fight false chargebacks with smart technology. The funding was raised across three tranches, including a Series B round led by Oak HC/FT and two previously unannounced rounds led by Zeev Ventures and F2 Venture Capital, respectively. False chargebacks, also known as “friendly fraud,†occur when shoppers incorrectly dispute charges to their credit/debit card, resulting in their financial institution canceling their payments and merchants losing earned revenues. Introduced in the 1970s, this system takes a big bite out of online retailers’ profits: last year, chargeback fraud cost merchants more than $125 billion in lost revenues and accounted for 85% of all reversed transactions. Nearly 80% of merchants still have no solution in place to help them identify and prevent such fraud. Founded by tech industry veterans Roenen Ben-Ami and Ofir Tahor, Justt fully automates chargeback disputes on behalf of merchants. The company’s AI-powered solution allows it to effortlessly flag incorrect chargebacks, which typically represent at least 85% of disputes. Justt leverages deep expertise navigating the antiquated and opaque chargeback system, together with smart tools, to build a system tailored to each merchant that gathers the most compelling evidence and submits it on their behalf. The result is a fully customized and hands off solution, eliminating the need for complex, costly, and time-consuming in-house mitigation programs. Formerly known as AcroCharge, Justt has experienced rapid growth in the last 11 months, with annual recurring revenue (ARR) growing 20% month-over-month and headcount increasing more than 25-fold to more than 110 employees. Strategic individual investors in Justt include David Marcus, former President at PayPal; Jacqueline Reses, former Head of Square Capital; and Gokul Rajaram, an executive at DoorDash. Before Justt, digital payments giant Melio’s in-house mitigation team was only able to reclaim about 30% of false chargebacks — but the company’s success rate soared almost threefold after they switched. “Justt’s hands-off solution integrates with our card processor, allowing us to shift our focus from the never-ending task of fighting chargebacks to conquering our core business goals,†said Matana Soreff, Melio’s Vice President of Risk & Compliance. Justt also features an innovative zero-risk business model, with no up-front fees and no need to pay a dime until funds are recovered. Instead, Justt is paid when businesses save by defeating false chargebacks — a unique win-win approach that ensures merchants always come out ahead. “The chargeback system is fundamentally unjust, but many merchants view their losses as simply the cost of doing business. At Justt, we believe there’s a better way, and that eCommerce sellers need someone in their corner as they navigate this archaic system,†said Justt CEO Ofir Tahor. “Justt is committed to providing a streamlined, cost-effective, and scalable solution for today’s top brands. With this funding, we’re ready to level the playing field for online merchants, helping them achieve better results, keep more of their revenues, and stay focused on growing their businesses.†About Justt Founded in February 2020, Justt is dedicated to helping online merchants navigate the archaic, costly, and fundamentally unfair credit and debit card dispute system. Using machine learning and deep domain-specific expertise, Justt — formerly known as AcroCharge — effortlessly flags incorrect chargebacks, and builds tailored solutions to gather and submit evidence on merchants’ behalf. The result: a fully customized, hands-off solution that defeats 85% of “friendly fraud†while eliminating the need for in-house mitigation programs.

Comments

There are 0 comments on this post