Why Brookfield Asset Management Is My 3rd Largest Position

Interest rates are hitting new lows, and the stock market valuations are historically high.

This is causing a rush to real asset investments, with nearly $50 trillion expected over the decade ahead.

The massive shift of capital will lead to some winners and losers. One way to profit here is to simply buy Brookfield - the #1 real asset investment specialist.

Looking for a portfolio of ideas like this one? Members of High Yield Landlord get exclusive access to our model portfolio. Get started today »

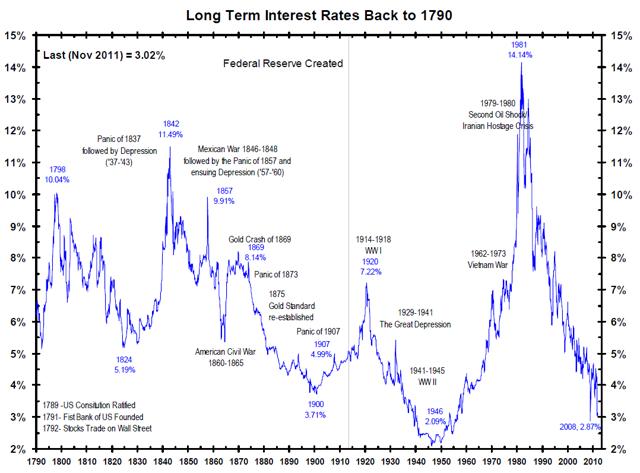

When the main investment objective is to generate highly consistent and safe income, investors have historically turned to bonds (LQD, VCLT, IEF). While this may have worked well in the past and allowed investors to earn a satisfying yield, today's environment is much less favorable to bond investors.

After a multi-decade long decline in interest rates, the yields are today at historically low levels:

Source: 222 Years Of Long-Term Interest Rates, Barry Ritholtz

This creates two major issues to bond investors:

- Not enough income is earned to meet their needs - this is particularly dangerous to large institutions and retirees.

- The value of their bond holdings may erode as interest rates return to normal and inflation accelerates.

What, then, is the solution in this low yield environment?

Trillions and trillions of dollars have flown to one particular asset class, and that is “Real Assetsâ€. In this article, we will discuss why this is relevant to your investment strategy and also describe one simple way to profit from the rush to real assets.

Real Assets: The Savior of Income Investors

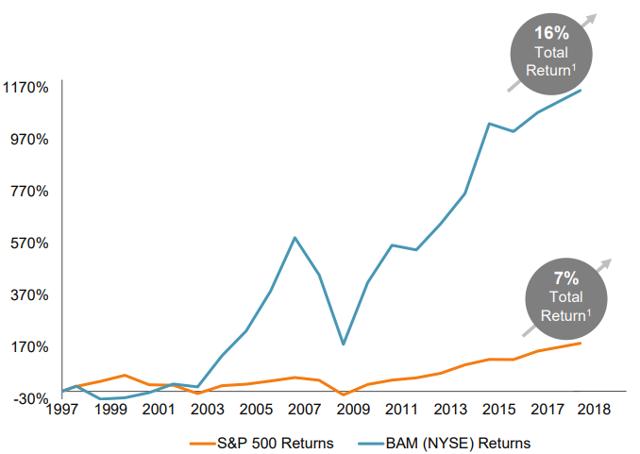

Over the past 20 years, Brookfield Asset Management (BAM) earned an unparalleled 16% annual return, compared to just 7% for the S&P 500 (SPY):

Source: Broofield Asset Management Annual Meeting of Shareholders Presentation, June 15, 2018

How, you asked?

Brookfield was early to recognize the value of “real asset†investments (such as real estate, energy pipelines, wind farms) and pioneered the space by building one of the leading asset management franchises.

In a world of low interest rates, real assets are particularly appealing because they offer:

- (1) Higher income yield: The 10-year treasury may yield only 2.1%, but real assets will often trade at yields in the 6-10% range - and can be leveraged to generate even greater cash-on-cash returns.

- (2) Greater total returns: Real assets generate high income, but they also appreciate in value and grow cash flow. A well-located office tower may yield 6% and grow in value by 3% per year. Add to that a bit of leverage and you can reasonably expect double-digit total returns.

- (3) Inflation protection: One of the biggest and most underrated risks today is accelerating inflation. When you invest in low-yielding bonds, you are at big risk. Real assets, on the other hand, are well-protected, as their income and values tend to grow along with inflation. As such, they provide a good hedge against inflation risk.

- (4) Valuable Diversification: Traditional assets (stocks and bonds) are highly volatile, and adding real assets to a portfolio has proven to lower volatility. As such, investors can profit from diversification benefits, while boosting income at the same time.

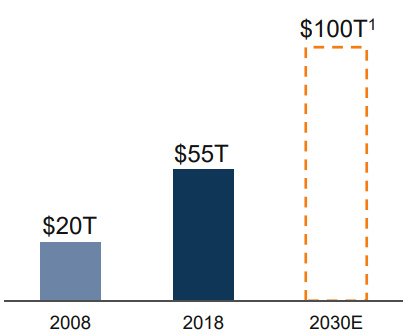

Other institutions have taken note of Brookfield’s success and started replicating similar real asset strategies. In just 10 years, institutional capital in this space has almost tripled, and another ~$50 trillion is expected in the decade ahead.

Source: Broofield Asset Management Annual Meeting of Shareholders Presentation, June 15, 2018

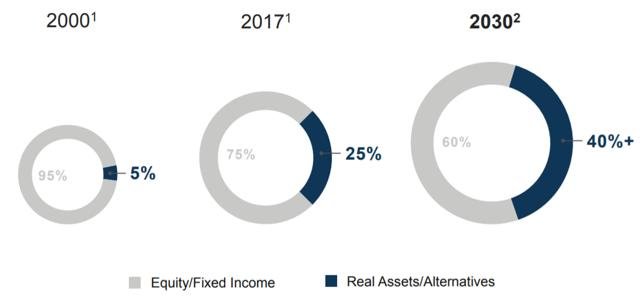

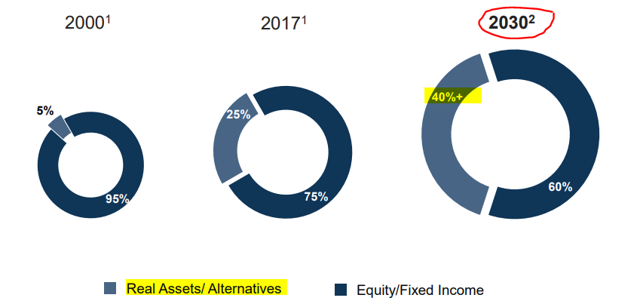

It helps that investors have historically been overly exposed to traditional assets, including stocks and bonds, and it is only since 2000 that investors started to heavily increase their allocation to real assets. Allocations to real assets were only 5% in 2000. Today, it is closer to 25%. And in 10 years, this figure could reach up to 40%:

Source: Broofield Asset Management Annual Meeting of Shareholders Presentation, June 15, 2018

How to Profit from this Massive Capital Shift?

At High Yield Landlord, we specialize in publicly traded real asset investments, such as REITs, MLPs, Utilities, etc. They provide us diversified exposure to real asset investments with liquidity, professional management and, most importantly to us, high passive income.

If income is not important for you, then another way to profit from this capital shift is to invest in Real Asset investment managers. Our favorite pick among asset managers is Brookfield - and the position is one of the largest in our portfolio. Here is why:

Reason #1 - Moated Business Model

Asset managers rarely enjoy a “true†moat that would protect their earnings. Brookfield is an exception here in that it enjoys many competitive advantages:

Large Scale

Brookfield has wide scale with over $365 billion under management and the resources to cater to the high capital needs of large institutional investors. Only a few other players have the same capability to take on and quickly allocate billions of capital.

Excellent Reputation

Brookfield enjoys a perfect reputation as a pioneer in real asset investing with a track record of market-leading performance. Having worked in private equity real estate, I have always had a very high opinion of the company.

Global Reach

It is one of the only asset managers with a true global reach, allowing it to leverage the growth on a world scale. Institutions want one-shop solutions, and Brookfield is one of the only asset managers to offer global solutions with funds from India to Brazil.

Skin in the Game

Unlike many of other asset managers, Brookfield is a major investor in its own funds. It is an investor first, asset manager second. The company has a 120-year heritable as owner of real assets with over $30 billion of its own money invested.

Permanent Capital and Long-Term Orientation

Brookfield manages a wide array of different investment vehicle, but importantly, most of these vehicles are long-term oriented or even permanent. This means that the company can count on recurring and sustainable fee income that won’t go away anytime soon - potentially ever.

At the exception of Blackstone (BX), Carlyle Group (CG) and perhaps one or two additional names, most asset managers do not enjoy the same strength in their franchise.

Reason #2 - A-rated Fortress Balance Sheet

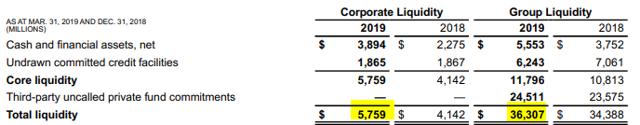

Just like Berkshire Hathaway (BRK.B), Brookfield has been building up a fortress balance sheet with significant liquidity to act opportunistically in the next downturn, when opportunities become abundant.

Brookfield currently enjoys an A- credit rating from the S&P, reflecting its conservative approach to financing. The CEO, Bruce Flatt, commonly describes the balance sheet as “impenetrable,†and there are over $36 billion of liquidity waiting to be invested.

Source: Broofield Asset Management Q1 2019 Supplemental Information

Whenever the cycle finally turns south, Brookfield will be among the few companies to thrive and pick up assets on the cheap from depressed sellers.

This is not the case for every asset manager, as many have sacrificed balance sheet quality for faster near-term growth in a late-cycle economy.

Reason #3 - Cash Flow is Set to Soar

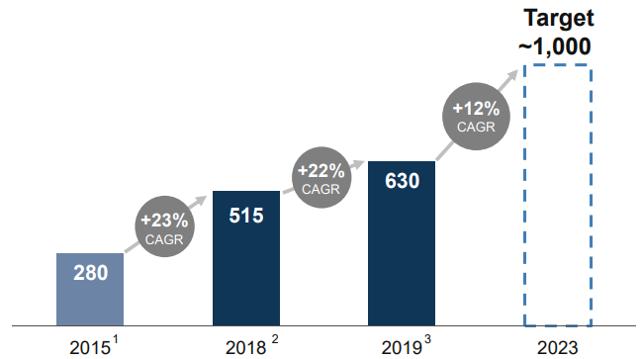

Brookfield expects to nearly double its assets under management (AUM) within the next four years:

Source: Broofield Asset Management Annual Meeting of Shareholders Presentation, June 14, 2019

Over the last year alone, it raised $31 billion of capital! The company is setting up new products and increasing the size of its existing ones to make place for additional funds. In an industry heading towards $100 trillion of institutional capital by 2030, Brookfield has already established the backbone to manage this growth.

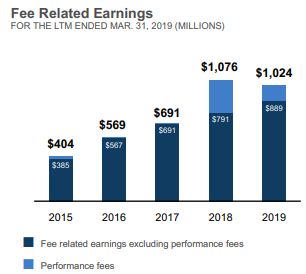

With rapid growth in assets under management, the fee income is also set to soar. Fee-related earnings have tripled over the past five years alone (expected full-year 2019):

Reason #4 - Discounted Valuation

To recap, Brookfield has all the characteristics of a “blue chip†company:

- A- rated balance sheet

- Premium franchise with excellent reputation

- Favorable industry with very positive outlook

- Recurring and defensive revenue

- Rapid cash flow growth

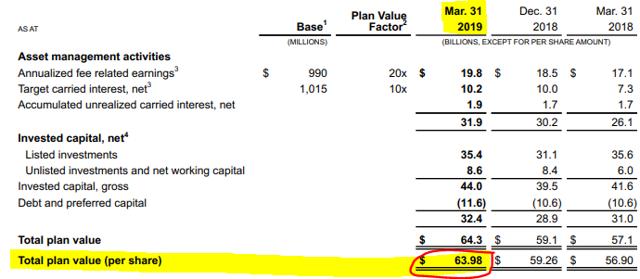

Yet, even with fairly conservative assumptions, the valuation of the shares appears to be discounted by roughly 20% at $47 per share. The management has an interesting table in the Q1 2019 Supplemental, in which they measure the fair value of their company. The calculation is simple: they look at the value of their own investments and add to it the value of their asset management business:

Even at $64 per share, which suggests ~35% upside, Brookfield would be a compelling pick. Here is why we believe that this valuation is on the conservative side:

Asset Management Valuation - The company uses a 20x multiple of fee-related earnings and adds a 10x multiple for carried interest. This is not particularly conservative, but you need to remember that this is a business that is growing at a rapid pace with an A- rated balance sheet.

Own Investments - The $32 billion valuation of its own investments is, however, likely understated because Brookfield owns a lot of undervalued investments.

This includes stakes in private funds, public securities, but most of it is in its four listed partnerships:

- Brookfield Property Partners (BPY)

- Brookfield Infrastructure Partners (BIP)

- Brookfield Renewable Partners (BEP)

- Brookfield Business Partners (BBU)

We currently consider these four partnerships to be undervalued by ~20% on average, making Brookfield’s stake in them very opportunistic with potential for upside in the coming years.

Bottom Line

In the majority of cases, we favor high income-producing real asset investments at High Yield Landlord. Our current yield is 7.5%, and this is why we do not hold Brookfield in our Core Portfolio. However, as part of my personal stock portfolio, Brookfield is one of the largest investments.

We are convinced that real asset investments are set to strongly outperform over the coming decades as yield-starved investors rush in to grab the last remaining income investments.

Comments

There are 0 comments on this post