Mortgage debt accelerated into 2020 and during pandemic lockdown

OTTAWA /CNW/ - Total outstanding mortgage debt stabilized in 2019, before accelerating at the beginning of 2020 and into the first months of pandemic-induced lockdown period in April and May 2020, according to CMHC's annual Residential Mortgage Industry report.

The Residential Mortgage Industry report provides in-depth view of the residential mortgage market in Canada: from mortgage origination to funding, covering insured and uninsured mortgages, and encompasses activity from all mortgage lender types. It is based on data available at the end of the second quarter of 2020.

Mortgage Lending Trends

- The acceleration of the total outstanding mortgage debt during the first half of 2020 partially reflected the trend in sales concluded before the pandemic-induced shutdowns and mortgage repayments.

- Canadian financial institutions have provided mortgage payment deferrals for up to six months to assist mortgage customers during COVID-19. These measures have resulted in a total of 760,000 deferred or skipped mortgage payments across chartered banks.

- As many non-bank financial institutions allow deferrals, we expect the total number of mortgages deferred to be higher. For example, there were 10% of deferral requests across Mortgage Investment Corporations (MICs).

- Mortgage deferrals will affect scheduled periodic repayments. With the average monthly payment being approximately $1,333 in Canada, the total amount of deferred mortgage repayments is estimated at slightly over $1 billion per month.

- There continues to be a risk that a significant increase in mortgage delinquency will be observed in the third or fourth quarter of this year as these deferral agreements come to an end.

Mortgage Rate Trends

- The overnight rate was cut by 150 basis points to help households and businesses through the economic disturbance. As a result, mortgage interest rates dropped in April 2020 on both variable-rate and fixed-rate mortgages.

- The widening positive gap between fixed and variable mortgage rates made variable-rate mortgages increasingly popular in April and May.

Mortgage Insurance Trends

- The upward trend in uninsured mortgages continued into the first quarter of 2020, as 63% of mortgages extended by chartered banks were uninsured.

- Portfolio-insured mortgages accounted for 31% of all insured mortgages from chartered banks at the end of 2019, down from 35% in 2018.

- Across non-bank mortgage lenders, the value of insured mortgages decreased slightly (1%) during the last quarter of 2019 compared to a year earlier.

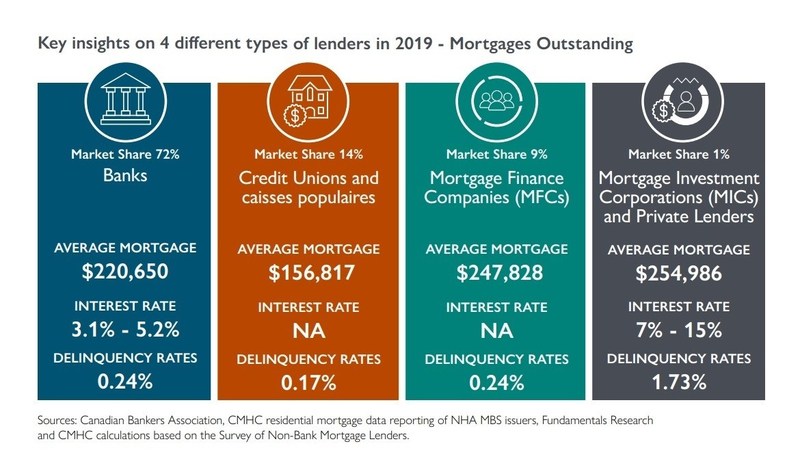

Mortgage Lender Type Trends

- In 2019, Canada's big six banks maintained their strong foothold in the housing finance market, with a 67% market share of newly extended mortgages.

- Mortgage Finance Companies (MFCs) hold 20% of the insured mortgage space and credit unions stand at 12%.

- Mortgage delinquencies of 90 days or more remained at low levels for all mortgage lender types, which suggests that a steady share of mortgage holders continued to be able to make their payments or were able to defer their mortgage payments.

- MICs continued to represent 1% in nationwide outstanding mortgages, valued at approximately between $14 billion and $15 billion in mortgage debt.

- Some MICs offered mortgage deferrals and other types of accommodations to financially strained mortgage consumers. An estimated 10% of mortgage consumers asked for a mortgage deferral.

Mortgage Funding Trends

- Deposits continued to be the primary source of mortgage funding for the big six banks (66%) and credit unions (77%).

- Covered bonds made up 17% of total mortgage funding for Canada's big six banks at the end of the first quarter of 2020, representing an increase of 4% from 2019.

- Private securitization, continued to account for a very small share of the mortgage funding mix in Canada, with just 1.1%. However, the residential mortgage-backed securities market appears to be expanding.

As Canada's authority on housing, CMHC contributes to the stability of the housing market and financial system, provides support for Canadians in housing need, and offers objective housing research and information to Canadian governments, consumers and the housing industry.

Comments

There are 0 comments on this post