India’s Richest Brothers and How They Grew $41 Billion Apart

Over the past year, the fortunes of the two brothers at the helm of India’s wealthiest dynasty have grown apart -- to about $40 billion apart.

Elder sibling Mukesh Ambani, 61, toppled China’s Jack Ma as Asia’s richest man, after driving a telecommunications revolution in India that propelled his petrochemicals conglomerate Reliance Industries Ltd. into the $100 billion club. His personal fortune had swollen to more than $40 billion as of Friday, according to the Bloomberg Billionaires Index, billions ahead of Ma and at similar levels to Microsoft Corp.’s former chief, Steve Ballmer.

Meanwhile Anil Ambani, two years his junior, has had a difficult year, with some of his businesses suffering legal and liquidity challenges that roiled stocks, cutting his personal fortune by almost half to $1.5 billion, according to the index.

Neither the brothers nor their groups responded to questions for this story regarding their wealth or business operations.

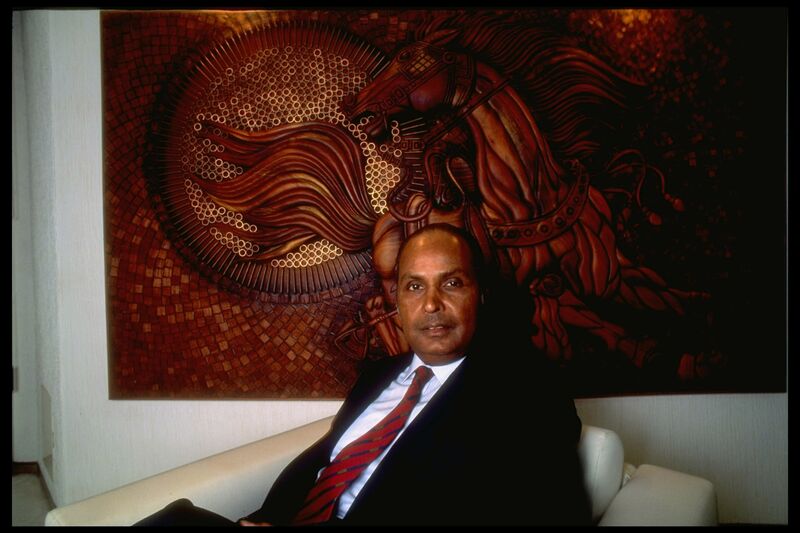

The tale of the two brothers’ diverging fortunes began 16 years ago, when their rags-to-riches father Dhirubhai Ambani, whose life inspired a Bollywood film, died of a stroke without leaving a will. The industrialist, who started out as a gas-station attendant in Yemen, had built a vast business empire, financing massive factories by selling so many shares to small investors that stockholder meetings had to be held in a football stadium.

Dhirubhai Ambani

A feud between his two sons following their father’s death dogged the group until their mother, Kokilaben, stepped in during 2005 and brokered a truce. Mukesh got control of the flagship oil refining and petrochemicals, while Anil got the newer businesses such as power generation and financial services. He also took over the telecoms unit, which under Mukesh had expanded aggressively by bundling phones with mobile connections at throwaway prices.

Telecoms Lure

At the time, the wireless division seemed to give Anil some of the more promising opportunities. Crude oil prices had climbed to a then-record price of more than $60 a barrel in 2005, sparking concern that refiners’ margins may get eroded. India’s burgeoning mobile-phone market was hailed as the future.

A non-compete clause between the brothers kept Mukesh out of that arena until the agreement was scrapped in 2010. Mukesh quickly returned, pumping in more than 2.5 trillion rupees ($34 billion) over the next seven years to build a speedier 4G wireless network for his Reliance Jio Infocomm Ltd.

“It was a very, very big bet,” said James Crabtree, a professor at the Lee Kuan Yew School of Public Policy in Singapore and author of the book “The Billionaire Raj,” which examined wealth inequality in India. Jio also gave Mukesh the chance to forge his own legacy beyond the shadow of the businesses he had inherited, he said. “Jio in that sense was an all-in bet.”

It took a long time to pay off. Reliance’s shares lagged S&P BSE Sensex index for most of the past decade as investors watched Mukesh pour money into his telecom network with little sign of a return at first.

Price War

When it came in 2016, the impact was dramatic. By July this year, less than two years after starting the service, Jio had signed up 227 million users and was making a profit. Rivals were bleeding as Mukesh’s upstart embarked on a devastating price war, offering monthly plans for as little as $2.

“Reliance’s strategy to diversify beyond the energy sector was the biggest game changer,” said Sanjiv Bhasin, executive vice president at India Infoline Ltd. “Mukesh Ambani had the 10-year vision to foresee that data will be the next gold and he invested heavily.”

What financed that investment was Dhirubhai’s old oil and petrochemicals business, which, expanded by Mukesh, still accounts for 90 percent of Reliance’s profit. Cash flow from the business, together with a blue-chip rating gave Reliance Industries access to a large pool of cheap capital. “Mukesh Ambani has very adroitly used this competitive advantage,” said Saurabh Mukherjea, founder of Marcellus Investment Managers.

Meanwhile, Anil has been selling assets to quell investor concerns around the indebtedness of some of his companies that contributed to declines in his shares.

Like his brother, Anil invested billions to expand his portfolio, but the younger brother didn’t have a cash cow like the oil refinery to finance growth. Instead, like other businesses in India and elsewhere, many of his companies increased debt.

Comments

There are 0 comments on this post